Discover Reliable Loan Providers for All Your Financial Requirements

In browsing the large landscape of monetary solutions, discovering reliable financing providers that deal with your particular requirements can be a challenging job. Whether you are considering personal finances, on the internet lenders, debt unions, peer-to-peer loaning platforms, or entitlement program programs, the alternatives appear countless. In the middle of this sea of selections, the vital concern remains - just how do you recognize the trustworthy and reputable avenues from the remainder? Let's explore some vital aspects to take into consideration when choosing loan services that are not only reputable yet additionally customized to meet your unique monetary demands - Loan Service.

Sorts Of Individual Fundings

When considering personal car loans, people can pick from different types customized to fulfill their particular economic requirements. For individuals looking to settle high-interest financial obligations, a financial obligation combination finance is a sensible option. Furthermore, individuals in demand of funds for home restorations or major purchases might opt for a home improvement car loan.

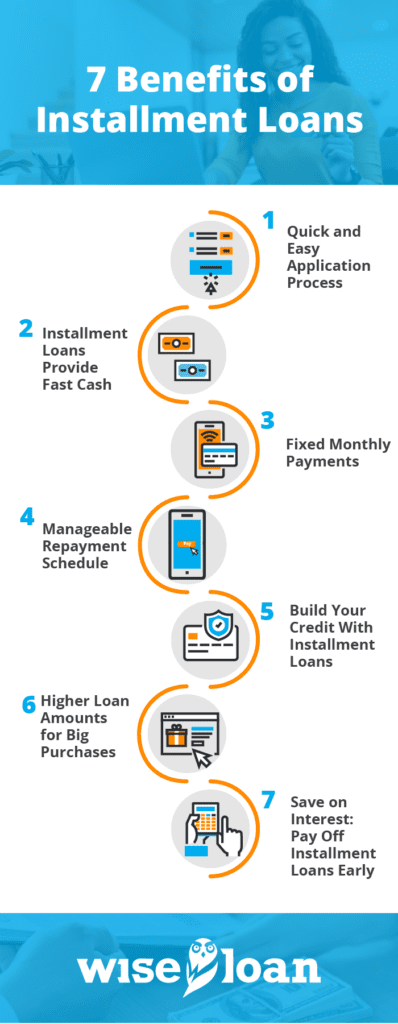

Benefits of Online Lenders

Understanding Cooperative Credit Union Options

Credit history unions are not-for-profit financial cooperatives that supply an array of items and solutions similar to those of financial institutions, including savings and checking accounts, car loans, credit report cards, and much more. This ownership framework typically translates into lower fees, affordable rate of interest prices on finances and cost savings accounts, and a strong focus on consumer solution.

Lending institution can be appealing to individuals seeking a much more personalized approach to financial, as they normally focus on member fulfillment over revenues. In addition, credit report unions typically have a solid community existence and might use financial education sources to aid participants improve their financial literacy. By comprehending the alternatives offered at credit report unions, people can make enlightened decisions concerning where to entrust their financial requirements.

Checking Out Peer-to-Peer Financing

Peer-to-peer financing platforms have obtained popularity as a different form of borrowing and investing over the last few years. These systems connect people or businesses looking for funds with capitalists happy to offer cash for a return on their investment. Among the crucial tourist attractions of peer-to-peer loaning is the potential for lower rates of interest compared to standard economic institutions, making it an attractive choice for consumers. Furthermore, the application procedure for obtaining a peer-to-peer lending is commonly structured and can lead to faster accessibility to funds.

Investors additionally gain from peer-to-peer financing by possibly earning greater returns contrasted to typical financial investment options. By reducing out the middleman, investors can directly fund debtors and get a portion of the rate of interest payments. It's essential to note that like any type of financial investment, peer-to-peer borrowing brings fundamental risks, such as the possibility of consumers failing on their fundings.

Entitlement Program Programs

In the middle of the advancing landscape of financial services, an important element to take into consideration is the realm of Federal government Support Programs. These programs play an essential role in supplying financial assistance and support to individuals and companies during times of demand. From unemployment advantages to little service finances, entitlement program programs intend to alleviate economic worries and advertise economic stability.

One prominent example of find more information an entitlement program program is the Small company Management (SBA) lendings. These fundings supply favorable terms and low-interest rates to help local business expand and navigate challenges - mca lender. In addition, programs like the Supplemental Nourishment Assistance Program (BREEZE) and Temporary Assistance for Needy Families (TANF) provide crucial support for individuals and family members encountering economic difficulty

Moreover, entitlement program programs expand past monetary aid, encompassing real estate aid, healthcare aids, and academic gives. These efforts intend to address systemic inequalities, advertise social well-being, and guarantee that all people have access to standard requirements and chances for innovation. By leveraging federal government aid programs, individuals and organizations can weather economic storms and make every effort towards a more safe economic future.

Verdict